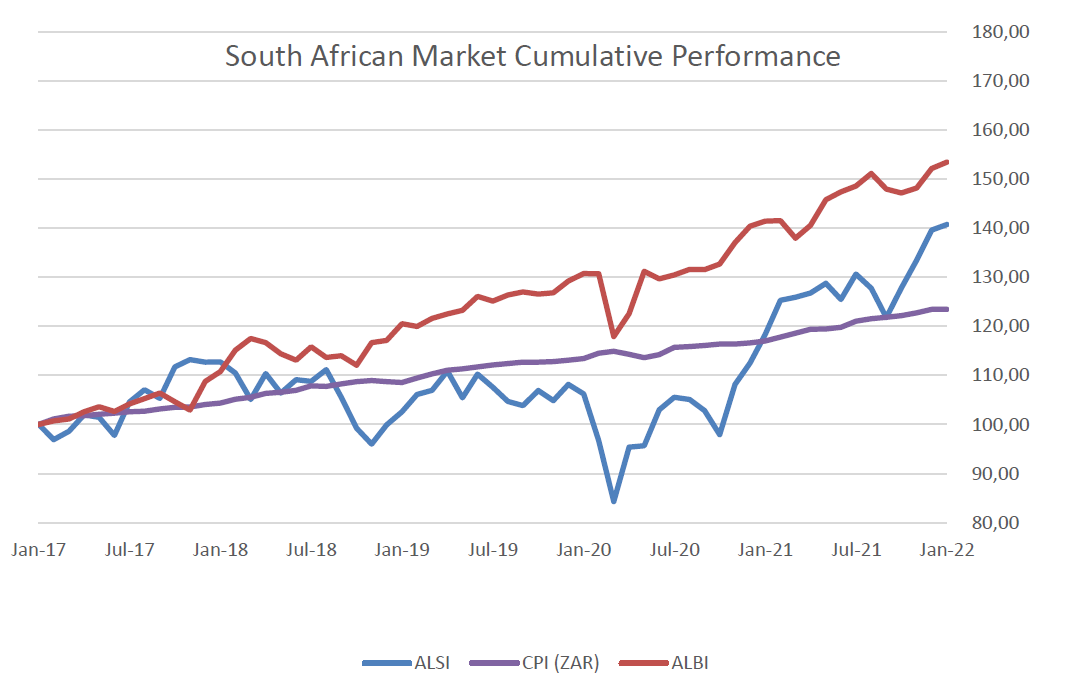

The South African Reserve Bank (SARB) has increased the repo rate by a further 25 bps following a 25 bps increase in November 2021. South African inflation ended last year at the higher end of the SARB’s target range of 3 -6%. The subsequent rate hikes are an effort to return inflation to the mid-point of the target range.

South African Markets (ZAR)

South African Market Cumulative Performance

South African Yield Curve

Offshore Markets*

Inflation***

Currencies (ZAR)

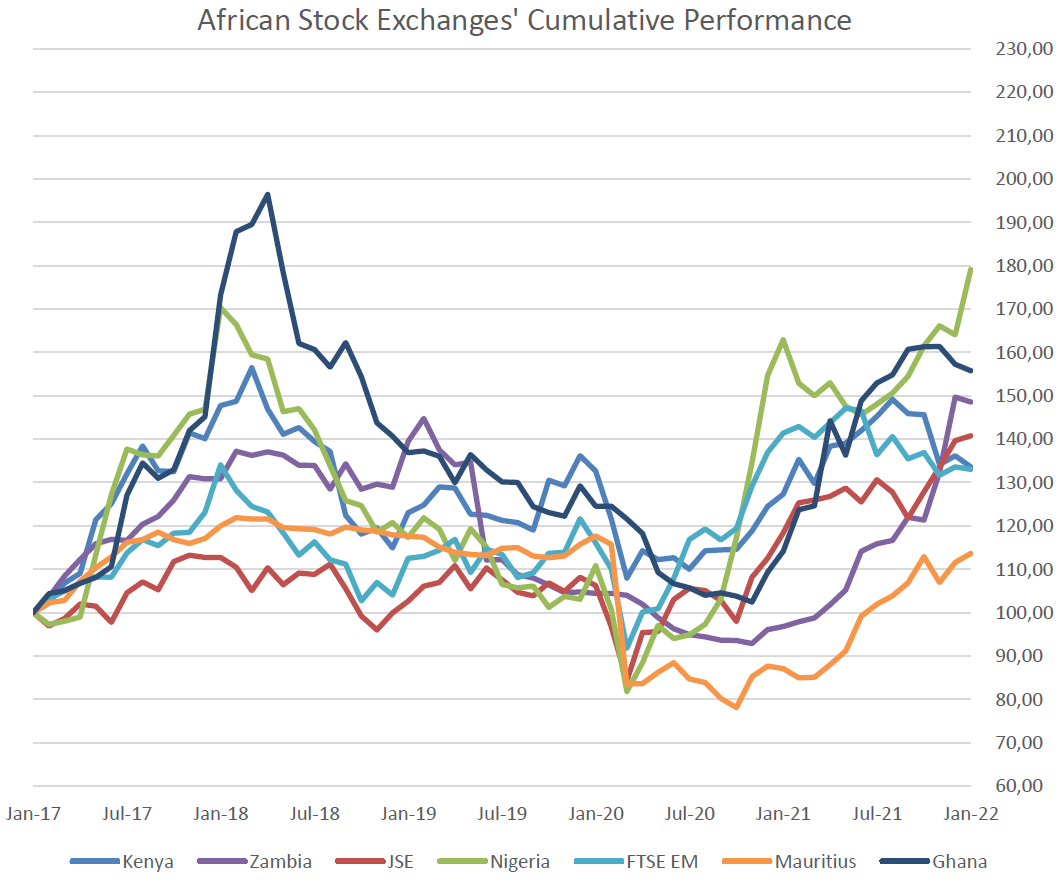

African Stock Exchanges’ Cum. Performance

Rand Exchange Rate

*** CPI is lagged by one month

Commentary

The JSE ended the month flat with a real return of 0.2% in local currency terms. The returns on other African markets considered were mixed with the Nigerian market (and the Mauritian market to a lesser extent) having a strong showing, whilst the other markets returned negatively in local currency terms.

The South African Reserve Bank (SARB) has increased the repo rate by a further 25 bps following a 25 bps increase in November 2021. South African inflation ended last year at the higher end of the SARB’s target range of 3 6%. The subsequent rate hikes are an effort to return inflation to the midpoint of the target range. Other countries considered operating at inflation levels above its longer-term (5 years) average include Zambia, Mauritius and Ghana.

The Rand strengthened against all currencies considered over the past month. Year on year, the Rand remains strong against most currencies considered barring only the Zambian Kwacha and the US Dollar