The South African reserve bank has increased the repo rate by 25 basis points to 3.75% p.a. over the last month whilst the JSE ended the month at a record high, posting real returns of 4.8% over the month.

South African Markets (ZAR)

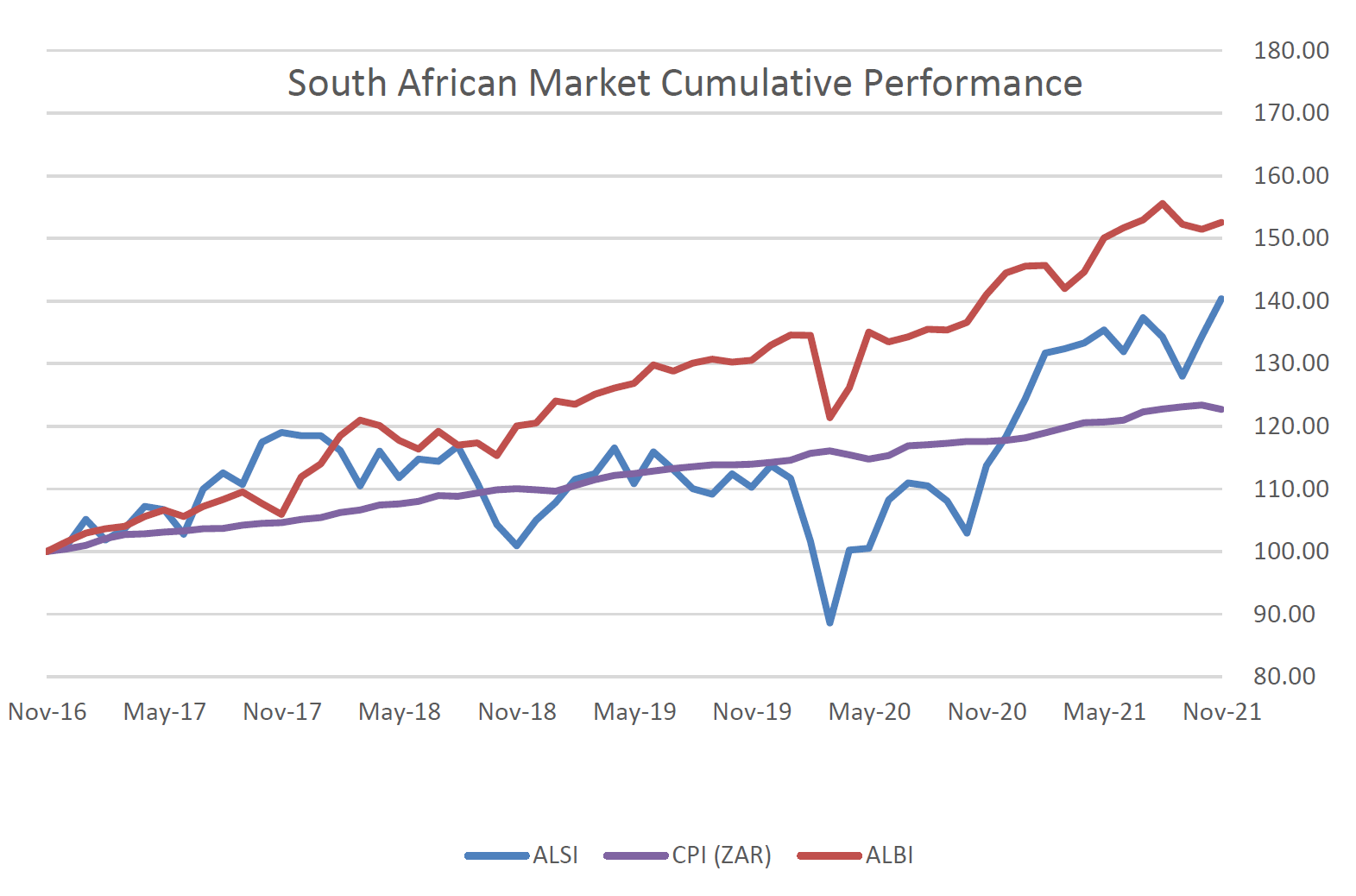

South African Market Cumulative Performance

South African Yield Curve

Offshore Markets*

Inflation***

Currencies (ZAR)

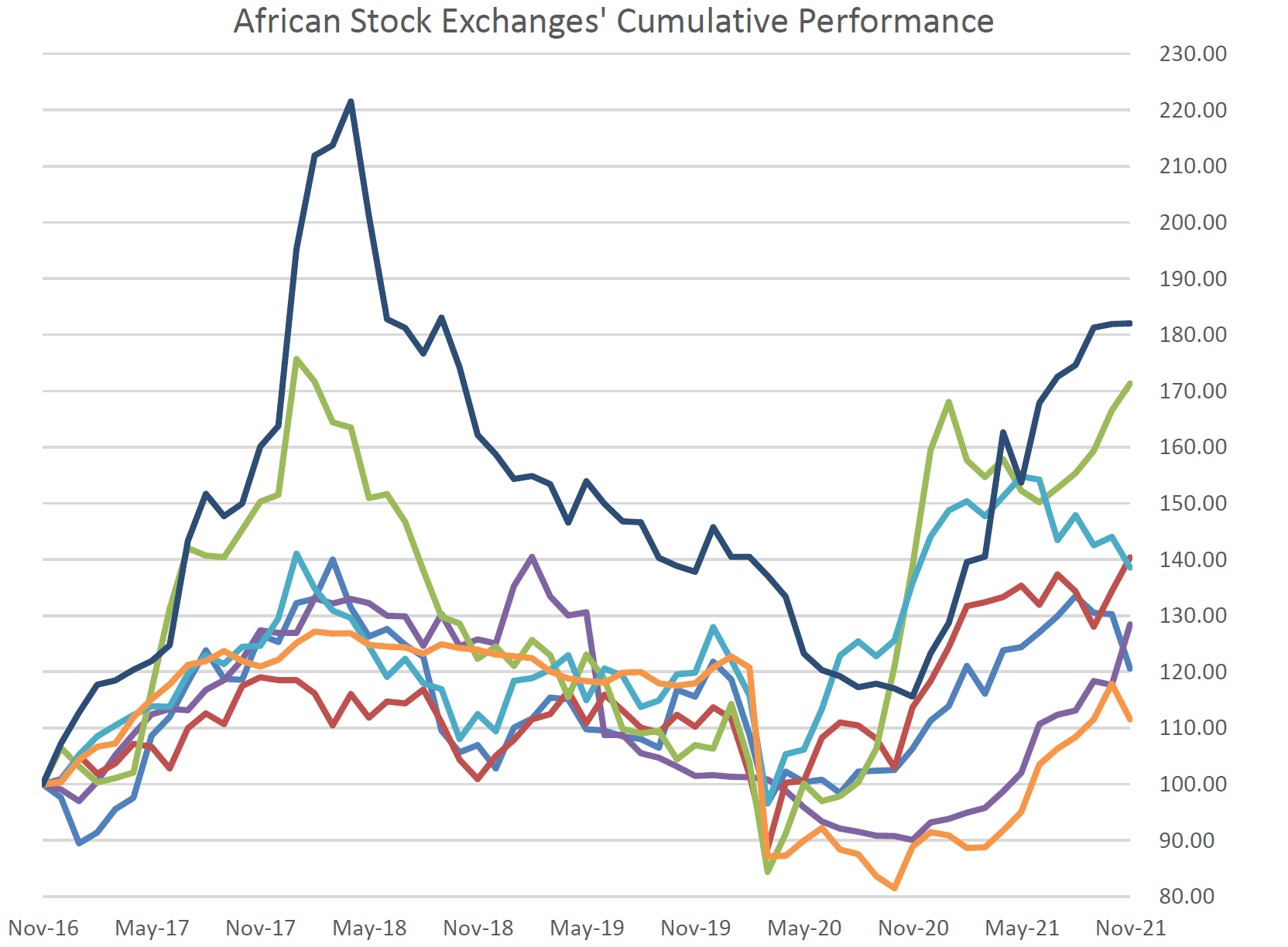

African Stock Exchanges’ Cum. Performance

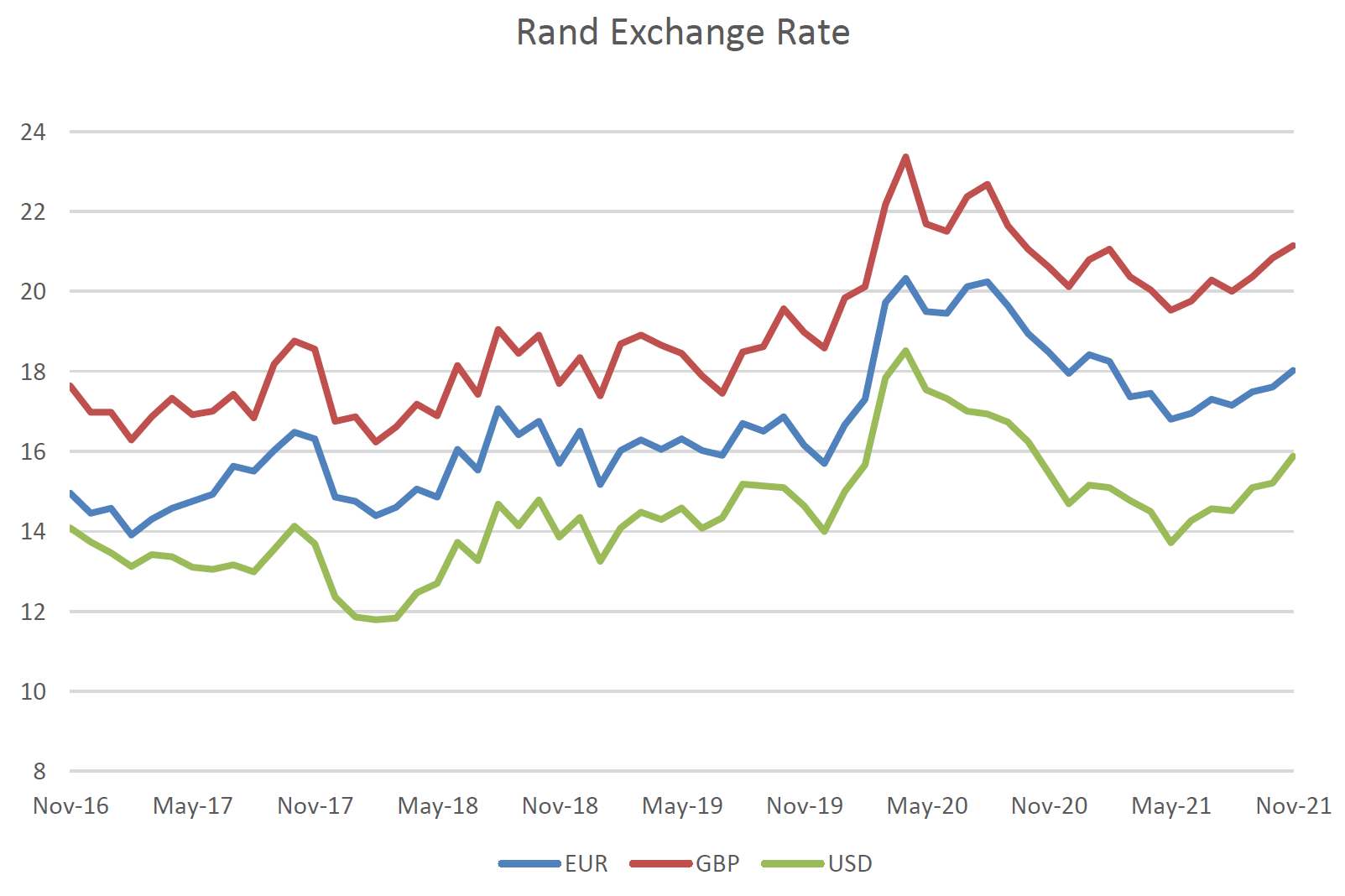

Rand Exchange Rate

*** CPI is lagged by one month

Commentary

The JSE ended the month at a record high posting real returns of 4.8% for the month. The monthly returns on other African

markets considered are mixed with the Zambian and Nigerian markets returning positively in real local currency terms whilst

other markets returned negatively.

The South African reserve bank has increased the repo rate by 25 basis points to 3.75% p.a. over the last month.

The South African equity market has outperformed the bond market by 3.75% over the past month. However, over the longer-term (5 years), the situation is reversed with the bond market outperforming the equity market generating an excess return of

1.80%.

Over the month, the Rand weakened against all currencies considered. Over the year, however, the Rand has strengthened

against the Euro as well as all African currencies considered except the Zambian Kwacha and the Kenyan Shilling.